At the end of every year, I always like to reflect on the year prior to see how things went, and where I could’ve improved. This year, we were all reminded that unexpected things can and do happen. And that’s why its important to come back to the basics. They’ve worked in the past and likely will in the future. Here are 10 tips I’ve learned first hand over my investing career.

1. Start early – timing the market vs time in the market.

There is a reason this is the number one tip on the list. Simply put, investing early is immensely important and over the long run can be the difference between hundreds of thousands (or potentially more!) in gains and profits. Timing the market is a notoriously difficult proposition. Often times our emotions cause us to sell into cash at market bottoms and buy the stock at the market tops. The graph below shows what can happen if you miss anywhere from 5-50 of the best days in the market.

2. Automate your savings

Without having excess funds, it’s impossible to invest. While creating a budget can work for some, I find that automating your savings with every paycheck can help you stay consistent and increase the value and cash flow of your portfolio over time. I almost consider savings as the “gas” for your investments, while the asset (stocks,bonds,etc) is your vehicle. The vehicle needs the gas to run and perform at its best. I would strive to put away at least 10-15% of every paycheck (the more the better). The earlier you can start this , the more you will thank yourself down the line.

Personally, I prefer to save using the app Acorns. With the app I set up daily withdrawals (you can stop them at any time and can increase/decrease the amount if needed). Acorns manages and invests the funds for you in a diversified portfolio of etfs. Once my balance in acorns hits a certain threshold I’ll withdraw and send over the funds to one of my brokerage accounts to manage them on my own. If you would like to sign up for acorns you can do so using the link below!

https://www.acorns.com/invite/XRQGDG

3. Build an emergency fund

Investing at its core is risk vs reward. Keep in mind you CAN lose money in the stock market. Thats why its so crucial to make sure you have an ample emergency fund PRIOR to investing. Often times bear markets can follow other negative influences in the market (ie: people lost their job due to Covid-19 and the market crashed simultaneously). The worst situation you can be in , is to need to sell your stocks at a massive loss during a downturn due to a cash shortfall. I recommend and keep roughly 6 month of expenses on the side , just in case an unexpected emergency or event occurs (job loss, pandemic, etc)

4. Learn the valuation basics

Without understanding how to value stocks, its difficult to tell whether you are getting a good deal on your investments. I wont go into too much detail here, as I plan to delve into this topic more in depth later on in other articles. But its important to learn the valuation basics. Learn to read balance sheets, understand the p/e , p/s, peg, p/b ratios. As long as you know the basics you can keep things light and always go deeper into these topics if you are interested.

5. Diversification and concentration

Diversification is the act of spreading your capital across different sectors, this way if one sector or stock does not perform well you do not have “all of your eggs in one basket”. When you have small account and are just starting out, getting proper diversification is difficult because you may not have enough capital to meaningfully spread across different investments.

To combat this, prior to picking individual stocks, I recommend building at least a 10k position in an exchange-traded fund (ETF) that tracks the broader market (like VOO, QQQ, SPY , etc). Once you have that, you can begin to invest in companies you like and see strong drivers for.

Conversely, one of the biggest mistakes I’ve made in the past is over-diversification. Spreading myself too thin over many positions (at one point i held more than 40). As opposed to concentrating my bets on 10-20 stocks. I now recommend roughly 10-15 positions as enough to have ample diversification as well as concentration in companies you think have a bright future.

6. Invest in what you know

I am a firm believer in investing in companies, ideas, and businesses you know and can understand. Understanding how a company makes money helps you make decisions about how that specific company or industry is going to perform in the future. Nowadays when investing has become about themes (ESG, electric vehicles, SPACs, Etc) its easy to jump on the bandwagon of investing in companies that may have attractive short term price growth and other speculative names as opposed to truly understanding where your money is going.

One basic way to see how well you understand a business is if you can simply explain how the company makes money, who its customers are, what products they sell, and what growth drivers the company has. As an example: Coca Cola is a company that sells soda, beverages, snacks, and other consumable goods to retail and wholesale businesses. One of Coke’s largest areas for growth is in the spiked seltzer product line, as well as direct to consumer sales.

Without really understanding what you’re investing in, there’s a very strong chance you can suffer serious losses. You won’t know when the market is valuing something incorrectly, when to buy, or when to sell. It’s a dangerous position to be in.

7. Commissions and fees

The rise of Robinhood has forced most brokerages to move to a 0 commission on trades model. If your broker is still charging you fees on trading, I highly recommend you change where you hold your money.

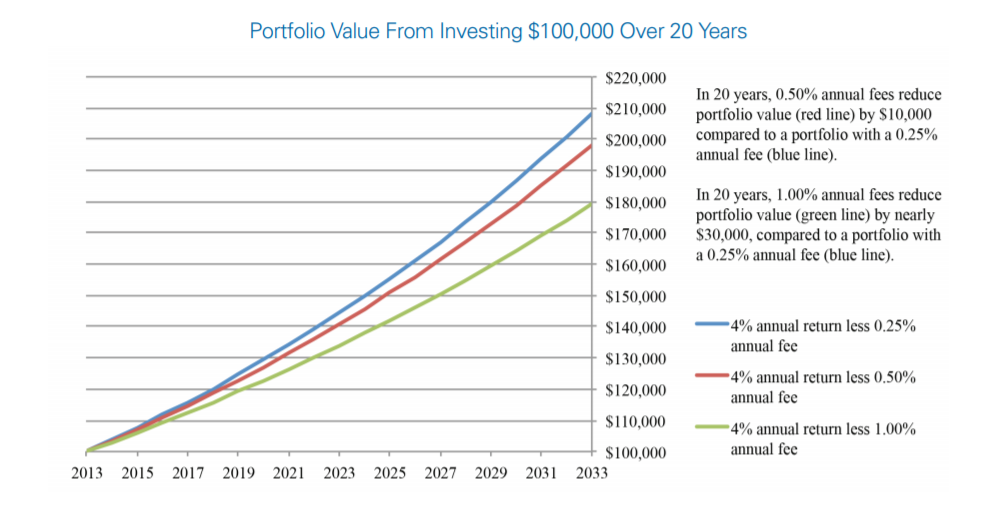

As per other fees, mutual funds do carry “expense ratios” these are costs which the asset manager charges you in order to maintain their fund. Some fees are large and others are small, but over time they can have a very large impact on the performance of your portfolio. The graph below shows the difference fees can make on a portfolio over the long term, as you can see just a difference in .75% per year adds up to roughly $30,000 in underperformance.

8. Commitment

When you first start investing, you may be tempted to take quick gains. However not only is this tax-inefficient (stocks held for more than 1 year are taxed at a lower rate), but it also prevents you from experiencing the benefits from the compound growth (which will be explained in tip 10). On the flip side if you experience losses early on it’s very easy to get disheartened only to watch the market make new highs a short period of time later (think about people who cashed out in March during the virus and never got back in).

One of my favorite strategies is dollar cost averaging. this is simply investing a set amount in certain investements periodcally. As an example, instead of buying 100 shares of apple today, you can buy 10 shares a week for the next 10 weeks. This prevents you from trying to time the market. If the stock falls in that month, you will buy shares at a lower price , if the stock goes up you are already holding shares and can partake in that gain as well (as opposed to holding funds and making a “hero’s bet”).

9. Set goals + asset allocation

Without specific goal setting its tough to know whether your strategy is working or not. Are you investing to purchase a property, send your kids to college, or perhaps fund a lavish retirement? All of these goals will require separate investing mindsets and time horizons (you should not bet your childs college fund on a risky startup play, while perhaps you can add that as a small portion of your portfolio with a long term retirement time horizon). My goal has always been to achieve financial independence and having the freedom to do what I love as opposed to needing to work for a paycheck (income from investments > expenses)

If youre not sure what your time horizions is , or just want to get started ASAP. A basic rule to thumb for asset allocation when it comes to retirement is to subtract 100 – your age. The difference in these is what you put into stocks , and the remainder is what you put into bonds and other safer investments (ie: a 20 year old will put 80% into stocks and 20% into bonds, vice versa for an 80 year old).

10. Reinvesting dividends + compound interest

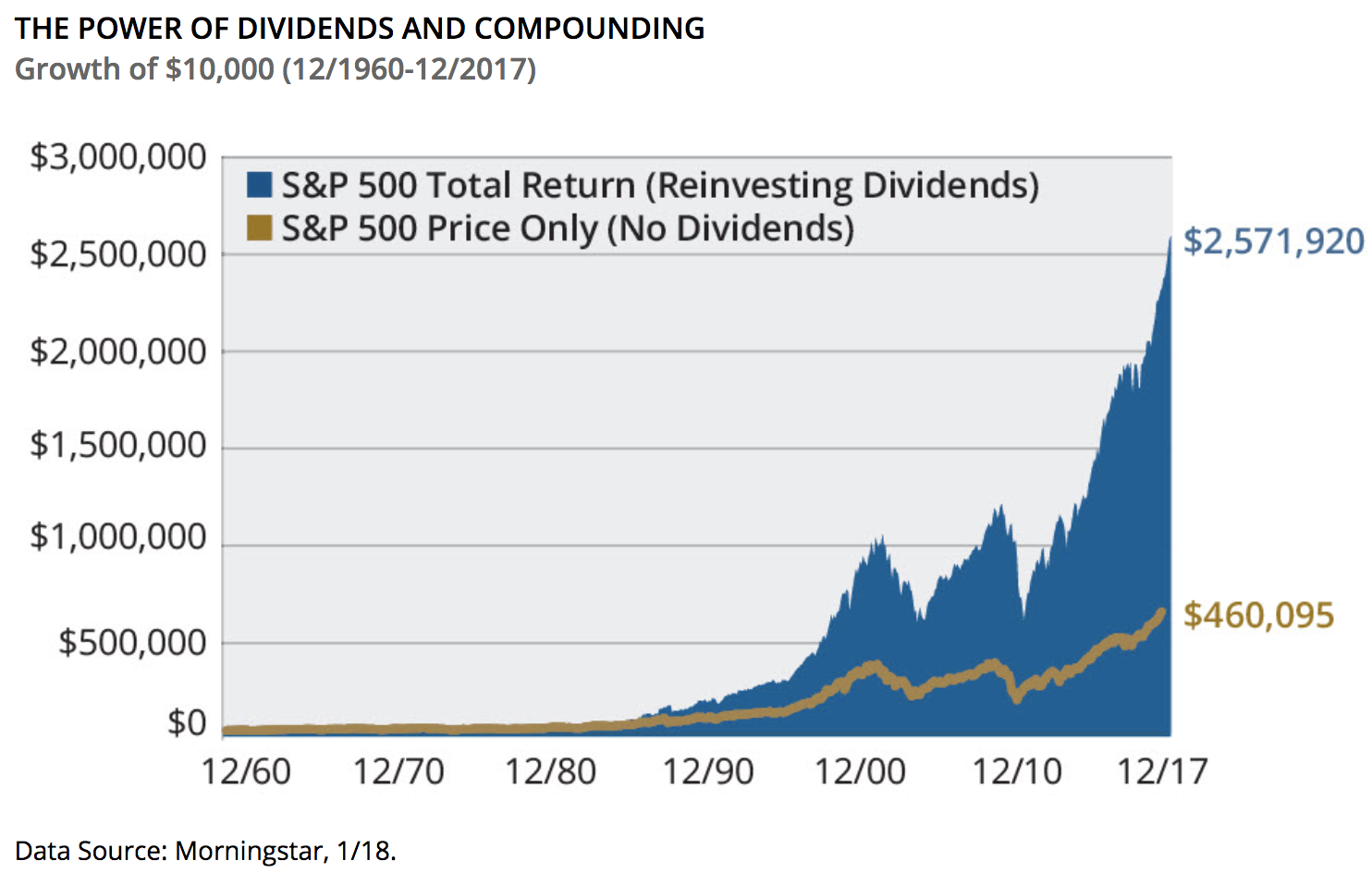

One of my favorite aspects of stock investing is dividends. These are cash payments made directly from the company to its shareholders as a reward for holding the stock. Dividends provide you with a stream of income from your holdings which can most importantly be reinvested. When you reinvest your dividends you take advantage of not only compound growth but also of dollar-cost averaging into your positions. We’ve gone over dollar cost averging already but its important to understand compound growth as well.

Einstein coined the phrase “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it” . Compound interest at its core is just earnings that you make on prior earnings. For example, if you earn a 10% dividend on a $100 dollar stock today. That dividend will pay you $10, increasing your total investment to $110. Upon your next 10% dividend, your new dividend amount will be $11, (10% of $110) increasing your new total to $121 . Your next dividend will be $12.10 and so on.

The chart below shows the stark difference between reinvesting vs taking the dividends as cash (and not reinvesting them).

Closing

Investing is made to be a long term game; one that can be incredibly rewarding. Following the tips outlined here as well as reading and formulating your own ideas are important in becoming the best investor you can.

Have any tips for others looking to start off with investing? leave them in the comments below and thanks for reading!

GREAT ARTICLE!

follow you on the Build Your Empire podcast.

you sound very knowledgeable.

thanks for all the guidance.