Paypal has been on a tear lately. With such a drastic run, is it too late to get into this payments behemoth? (All numbers/Data from August 14th. Data provided by Atom finance)

Background:

Paypal is a fintech company that focuses on the development of digital payment platforms. The companies products include: PayPal, PayPal Credit, Braintree, Venmo, Xoom, and Paydiant products.

PayPal has designed a clear path forward as it rides on the tailwinds of 3 major secular trends. The rise of ecommerce, cashless transactions, and mobile payment solutions. Its revenue has been increasing rapidly and now even surpasses the likes of payment giant Mastercard . Legitimizing the company as major player in the space.

Deep dive

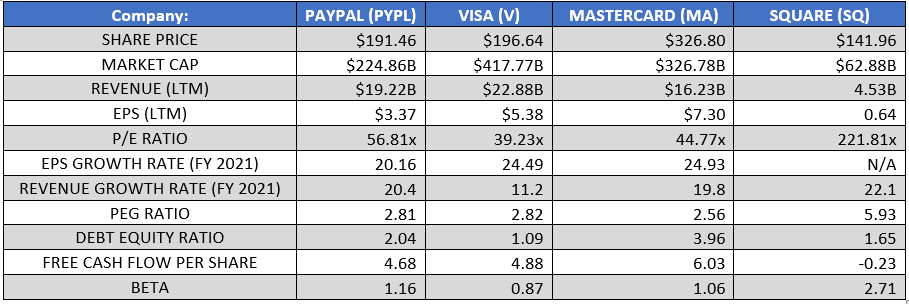

While Paypal certainly isn’t the largest, fastest growing, or the cheapest, we do see several indicators that the stock will continue to rise.

Looking at the top line we see that Paypal has now surpassed the revenue generated by MasterCard over the last 12 months. Furthermore we see that the revenue growth rate is higher than both V and MA, while utilizing a relatively moderate amount of debt at a 2.04 debt/equity ratio (compared to MA’s 3.96). Paypal is poised to continue its topline growth as the longer term effects of the coronavirus indicate a migration to digital payment solutions. In the most recent quarter Paypal reported an increase of 21.3 million new users as well as 30% YOY total payment volume growth. As covid continues to spread around the world, and we adjust to the new normal we can expect to see rapid adoption of the platform continuing in both new users and payment volume.

Investors know that the company is positioned well for success in the future, and are willing to pay a premium as the stock’s fundamental’s improve. Paypal has made some strategic acquisitions in the past and as of its last earnings report is holding over 13B in cash and short term investments. Knowing management, this cash will likely either be headed to investing in developing new payment capabilities or to finance a new acquisition. Primarily with the Braintree acquisition (venmo) the company has shown an impressive ability to rapidly grow companies they purchase.

With 60million daily active users along with and total payment volume increasing at 52% in the second quarter, venmo is quickly becoming the millennial’s favorite way to pay one another. With the large amount of transactions being conducted via venmo, Paypal has a direct path to grow both the top and bottom lines. Primarily as they begin to flesh out the monetization of the platform.

As long as online payments and transactions continue to rapidly increase, we should continue to see robust growth in both the revenue and eventually in the earnings of Paypal. However the growth does come at a cost. Paypal is not cheap on an earnings basis, mainly because funds are being used to grow the top line, while keeping a modest level of debt on the books. With a beta of 1.16 the stock sports some decent premiums when looking at cash secured puts. If you have the cash on the side and feel comfortable with options, it could be a strategy to get the stock a cheaper price than where it trades today.

If not, dont fear! Based on the earnings and revenue prospects, managements experience handling acquisitions, and larger secular trends, the company is poised to continue its run. If you dont have the cash on the side to sell puts, dollar cost averaging into the stock could be a good strategy for you.

I hope you enjoyed the article! If so please make sure to check back often and let us know what you would like to hear next!